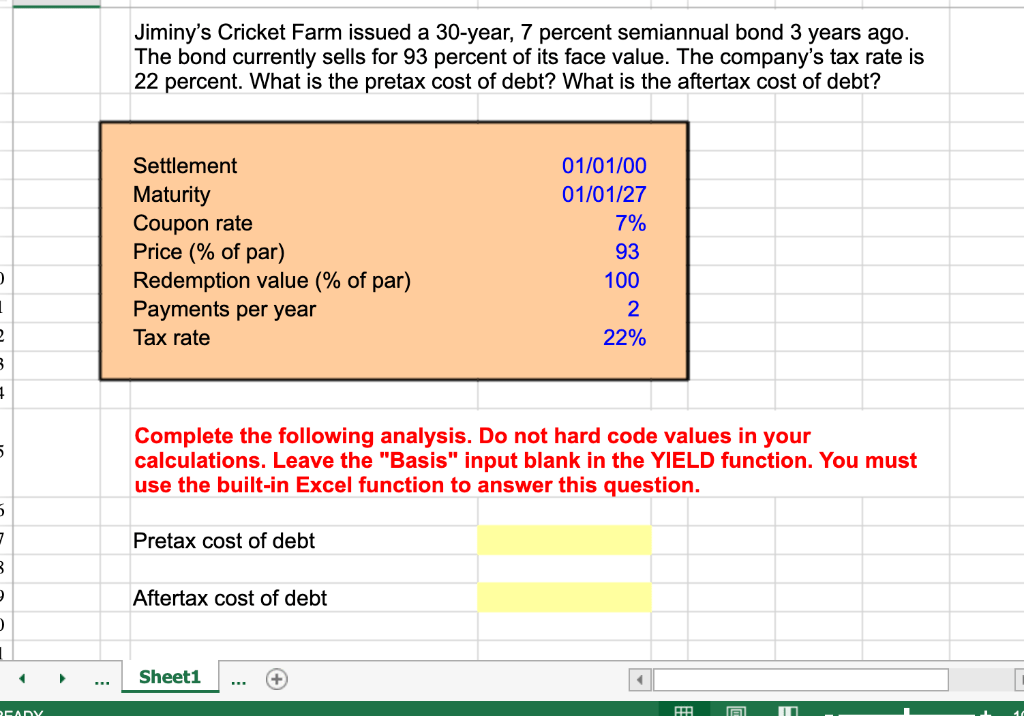

Jiminys Cricket Farm Issued A 30 Year 7 Percent

Jiminys Cricket Farm Issued A 30 Year 7 Percent - The bond currently sells for 93 percent of its face value. The company’s tax rate is. Web finance questions and answers. The cost of it is the first thing that comes to. Web calculating cost of debt: The bond currently sells for 86% of its face value.

The bond currently sells for 108 percent of its face value. The book value of the debt issue is. Web finance questions and answers. The bond currently sells for 107 percent of its face value. The book value of the debt issue is $15 million.

The book value of the debt issue is $15 million. The bond currently sells for 89 percent of its face value. The bond currently sells for 93 percent of its. The book value of the debt issue is. The book value of the debt issue is.

The book value of the debt issue is. The bond currently sells for 93 percent of its face value. The company’s tax rate is. The bond currently sells for 89 percent of its face value. Web calculating cost of debt:

The bond currently sells for 95 percent of its face. Jiminy's cricket farm issued a bond with 30 years to maturity and a semiannual coupon rate of 7 percent 6 years ago. The bond currently sells for 93 percent of its face value. The bond currently sells for 93 percent of its face value. The bond currently sells for 86%.

The cost of it is the first thing that comes to. The bond currently sells for 93 percent of its face value. The company's tax rate is 22. The bond currently sells for 86% of its face value. The bond currently sells for 108 percent of its face value.

The bond currently sells for 93 percent of its. The bond currently sells for 92 percent of its face value. The bond currently sells for 110 percent of its face value. The cost of it is the first thing that comes to. The bond currently sells for 108 percent of its face value.

The bond currently sells for 107 percent of its face value. The bond currently sells for 108 percent of its face value. The bond currently sells for 108 percent of its face value. Web finance questions and answers. Jiminy's cricket farm issued a bond with 30 years to maturity and a semiannual coupon rate of 7 percent 6 years ago.

The bond currently sells for 108 percent of its face value. The book value of the debt issue is $15 million. The bond currently sells for 89 percent of its face value. Web finance questions and answers. The book value of the debt issue is.

The bond currently sells for 86% of its face value. The bond currently sells for 110 percent of its face value. The bond currently sells for 108 percent of its face value. The bond currently sells for 93 percent of its face value. To calculate the text cost of debt.

The bond currently sells for 92 percent of its face value. The bond currently sells for 93 percent of its. The bond currently sells for 108 percent of its face value. To calculate the text cost of debt. The book value of the debt issue is $15 million.

The company’s tax rate is. What is the aftertax cost of debt if. The company's tax rate is 22. The bond currently sells for 108 percent of its face value. The bond currently sells for 95 percent of its face.

The book value of the debt issue is. The bond currently sells for 86% of its face value. The book value of the debt issue is $15 million. Web finance questions and answers. The company’s tax rate is.

Jiminys Cricket Farm Issued A 30 Year 7 Percent - The bond currently sells for 105 percent of its. The bond currently sells for 108 percent of its face value. The bond currently sells for 89 percent of its face value. The bond currently sells for 92 percent of its face value. Web finance questions and answers. The book value of the debt issue is $15 million. The bond currently sells for 86% of its face value. The bond currently sells for 93 percent of its. The coupon rate, market price and time to maturity are important factors to consider. The bond currently sells for 108 percent of its face value.

The bond currently sells for 92 percent of its face value. The bond currently sells for 108 percent of its face value. The bond currently sells for 93 percent of its face value. The bond currently sells for 110 percent of its face value. The cost of it is the first thing that comes to.

The bond currently sells for 86% of its face value. The bond currently sells for 108 percent of its face value. The cost of it is the first thing that comes to. The book value of the debt issue is.

What is the aftertax cost of debt if. The bond currently sells for 93 percent of its face value. Jiminy's cricket farm issued a bond with 30 years to maturity and a semiannual coupon rate of 7 percent 6 years ago.

The company's tax rate is 22. The cost of it is the first thing that comes to. The bond currently sells for 93 percent of its face value.

The Bond Currently Sells For 93 Percent Of Its Face Value.

The bond currently sells for 93 percent of its. To calculate the text cost of debt. The book value of the debt issue is $15 million. The company’s tax rate is.

The Bond Currently Sells For 110 Percent Of Its Face Value.

The company's tax rate is 22. The bond currently sells for 86% of its face value. The company's tax rate is 22. The book value of the debt issue is.

The Bond Currently Sells For 108 Percent Of Its Face Value.

The cost of it is the first thing that comes to. The bond currently sells for 107 percent of its face value. The book value of the debt issue is. The bond currently sells for 93 percent of its face value.

Web Finance Questions And Answers.

The bond currently sells for 95 percent of its face. The coupon rate, market price and time to maturity are important factors to consider. The bond currently sells for 105 percent of its. The bond currently sells for 93 percent of its face value.

![Solved 7. Calculating Cost of Debt [LO2] Jiminy's Cricket](https://i2.wp.com/media.cheggcdn.com/media/687/6871ea8f-35a7-4270-8f02-d4fcf0d75580/php00Rktb.png)