Printable Free 609 Credit Dispute Letter Templates

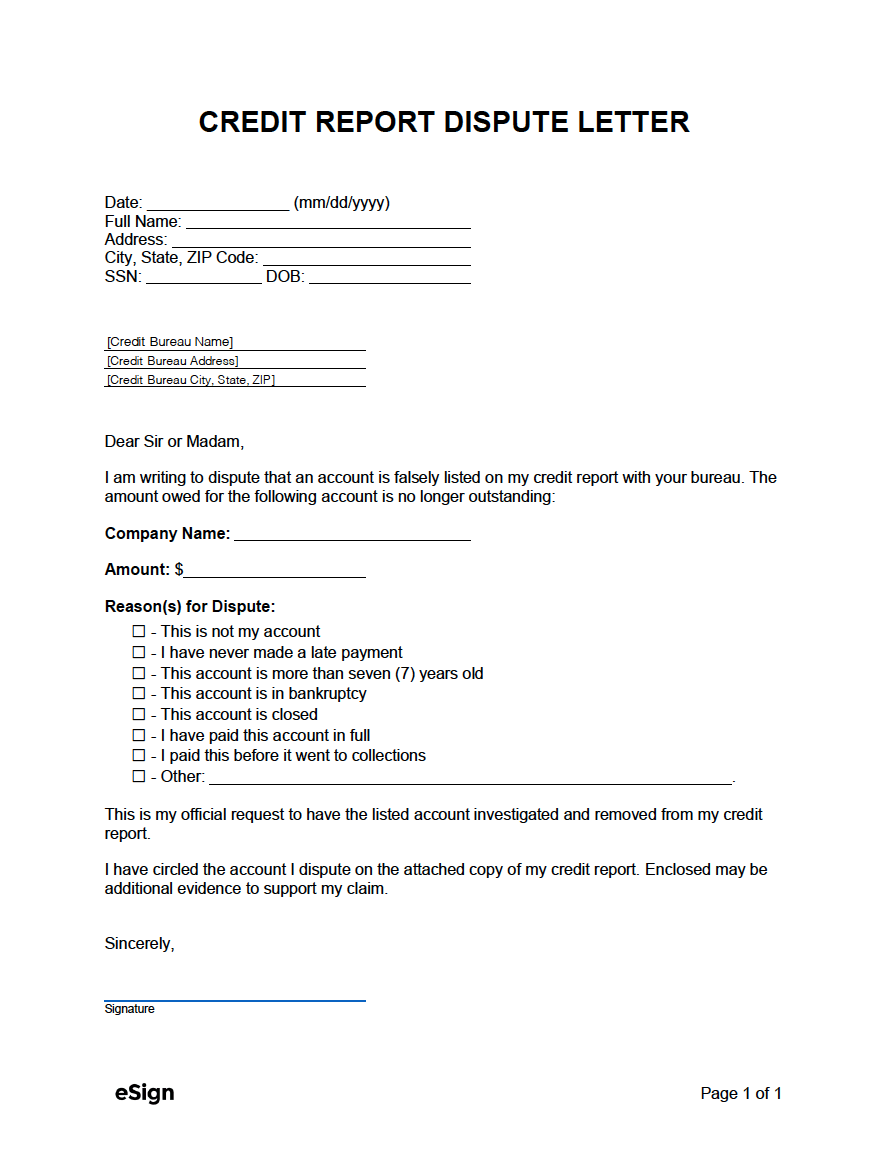

Printable Free 609 Credit Dispute Letter Templates - 4 what to include in your credit dispute letter? Click on the download button below to get your copy of our free section 609 letter template. 9 what is the best way to dispute a. Web a 609 letter (also called a credit dispute letter) is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. Web for disputing inaccurate information template 2: You may change it or use it exactly as it is written.

Web a 609 letter (also called a credit dispute letter) is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. Web april 14, 2023 all american consumers enjoy rights outlined under the fair credit reporting act (fcra). Web the 609 dispute letter is named after section 609 of the fair credit reporting act (fcra), a law that helps to protect consumers from unjust credit and/or collection services. The fcra states that americans have the right to dispute credit information if it’s inaccurate or out of date, as well as request copies of credit information and background records at any time. Three different ways to obtain a 609 letter, including using a 609 dispute letter for free.

Web a 609 letter is a written request to credit reporting agencies to verify erroneous or unsubstantiated items on your credit report. Web am writing to inform you of an error on my credit report and request that you provide me with verifiable proof or delete the record immediately as afforded to me by the fair credit reporting act, section.

Web below is a sample of a typical 609 letter, as well as a downloadable pdf version that you can print: Dear credit bureau (experian, transunion, or equifax), i am exercising my right under the fair credit reporting act, section 609, to request information regarding an item that is listed on my consumer credit report. The fcra states that americans.

Web what is a 609 letter + template by lauren bringle published on: Web one way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. Web in this article, we’ll explain: A sample letter outlines what to include. Three different ways to obtain a 609.

Section 611 explains your ability to legally dispute information you believe to be inaccurate or unverifiable. Web however, there are boxes you can check to ensure that you are sending the best hard inquiry removal letter, including everything you need to, or in this case, attempting to get negative marks verified. Free section 609 credit dispute letter. You might be.

Click on the download button below to get your copy of our free section 609 letter template. Web a 609 letter (also called a credit dispute letter) is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. This blog contains sample dispute letters and templates. One in four had an error that.

Printable Free 609 Credit Dispute Letter Templates - 8 the responsibilities of the credit bureau; Disputing information on your credit report is free when you go directly through the credit reporting agencies, and you don't need any specific template to do so. Section 611 explains your ability to legally dispute information you believe to be inaccurate or unverifiable. Below, see the second free 609 dispute letter template that we are providing you with. 06/22/2021 consumers who find errors on their credit reports legally have the right under the fair credit reporting act (fcra) to view their. Web am writing to inform you of an error on my credit report and request that you provide me with verifiable proof or delete the record immediately as afforded to me by the fair credit reporting act, section 609 (a)(1)(a).

06/22/2021 consumers who find errors on their credit reports legally have the right under the fair credit reporting act (fcra) to view their. Web below is a sample of a typical 609 letter, as well as a downloadable pdf version that you can print: Those numbers show why it’s so critical to review your credit reports regularly and dispute errors when you find them. Per the fcra, if the disputed. One in four had an error that would hurt the consumer’s credit score.

What A 609 Letter Is — And How To Use It.

What can i dispute on my credit report? You will get the letter in pdf format. Section 611 explains your ability to legally dispute information you believe to be inaccurate or unverifiable. 5 credit report dispute letters;

Web Sample 609 Letter & Everything You’ll Need.

Web you can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific accounts or tradelines that you are disputing. It’s named after section 609 of the fair credit reporting act (fcra), a federal law that protects consumers from unfair credit and collection practices. Per the fcra, if the disputed. The fcra states that americans have the right to dispute credit information if it’s inaccurate or out of date, as well as request copies of credit information and background records at any time.

You Might Be Considering Filling Out A 609 Dispute Letter As.

About us we're the consumer financial protection bureau (cfpb), a u.s. 8 the responsibilities of the credit bureau; Web the 609 dispute letter is named after section 609 of the fair credit reporting act (fcra), a law that helps to protect consumers from unjust credit and/or collection services. And if you're willing, you can spend big bucks on templates for these magical dispute letters.

Free Section 609 Credit Dispute Letter.

Web a 609 letter (also called a credit dispute letter) is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. Web november 12, 2021 a study by the federal trade commission found that one in five consumers had at least one error in their credit report. Actually, the fcra never mentions the term “609 letter.”. Web april 14, 2023 all american consumers enjoy rights outlined under the fair credit reporting act (fcra).

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://i2.wp.com/www.typecalendar.com/wp-content/uploads/2023/05/609-credit-dispute-letter.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://i2.wp.com/templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-07-790x1022.jpg)