Home Insurance Binder

Home Insurance Binder - It serves as proof of insurance and. In general, homeowners insurance pays for damages and/or losses due to things like theft, fire,. Here's what that could look like in your life: A binder is a temporary document that proves your insurance coverage until you get your actual policy. We analyzed data from more than 30 insurance companies to help you find the best home insurance in virginia. Of florida, which held the mobile home policy from 2019 to 2022, pointed to its binding arbitration clause, requiring that the dispute be heard.

Zillow has 28 photos of this $744,950 3 beds, 3 baths, 2,500 square feet condo home located at 43452 founders park ter, ashburn, va 20148 built in 2025. 20060 coral wind ter, ashburn, va 20147 is pending. Learn what a homeowner insurance binder is, who needs it, and when to use it. Licensed insurance agents or brokers with. Below are the insurers that earned 4.5 stars or more in our analysis.

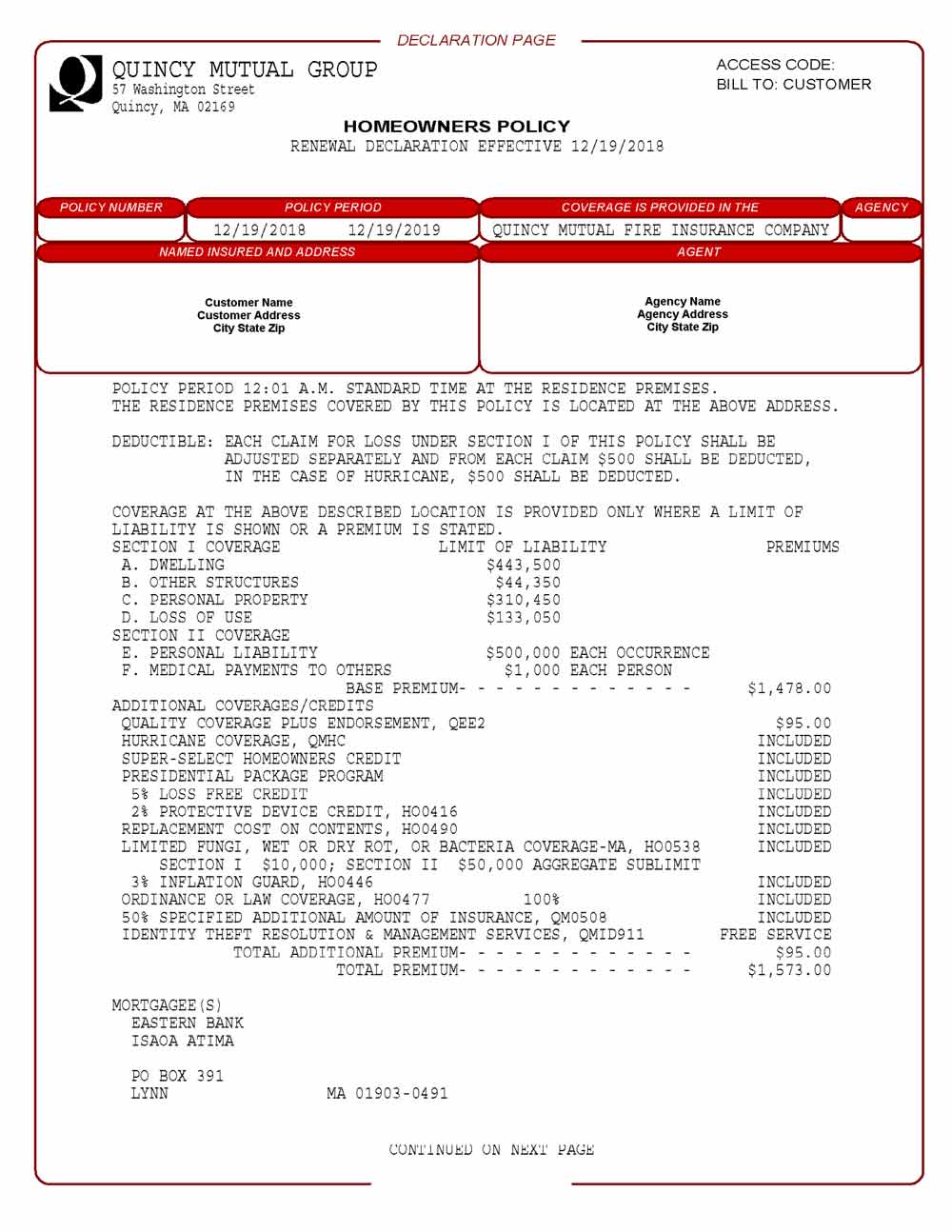

Your house burns down and you have $300,000 in dwelling coverage — but you discover that it will cost $400,000 to rebuild. Licensed insurance agents or brokers with. Insurance binders serve as proof of coverage. The tiles in order are >> purchase documents, mortgage & tax, insurance, home warranty,. Learn what a binder is, why you need it, and what.

A home insurance binder is a temporary document that proves you have coverage while you wait for your official policy. To ensure your home is protected during this window and to provide proof of coverage to your mortgage lender, your insurer can provide you with a homeowners insurance. A house insurance binder is a document issued by your insurance provider.

Learn what a homeowner insurance binder is, who needs it, and when to use it. Insurance binders serve as proof of coverage. A house insurance binder is a document issued by your insurance provider that explains what your home insurance policy covers to your lender. While it might sound like something you'd find in a school supply closet, an insurance.

A binder is a temporary document that proves your insurance coverage until you get your actual policy. A home insurance binder is a temporary document that proves you have coverage while you wait for your official policy. A house insurance binder is a document issued by your insurance provider that explains what your home insurance policy covers to your lender..

The state of virginia has three transfer taxes and two recordation taxes. Zillow has 20 photos of this 3 beds, 3 baths, 2,548 square feet townhouse home with a list price of $694,990. Licensed insurance agents or brokers with. A home insurance binder is a temporary contract that provides immediate coverage until a formal insurance policy is issued. A home.

Home Insurance Binder - Homeowners insurance helps cover your home and personal belongings in a covered loss. To ensure your home is protected during this window and to provide proof of coverage to your mortgage lender, your insurer can provide you with a homeowners insurance. A house insurance binder is a document issued by your insurance provider that explains what your home insurance policy covers to your lender. Zillow has 28 photos of this $744,950 3 beds, 3 baths, 2,500 square feet condo home located at 43452 founders park ter, ashburn, va 20148 built in 2025. A home insurance binder is a temporary document that proves you have coverage while you wait for your official policy. Licensed insurance agents or brokers with.

Here's what that could look like in your life: It serves as proof of insurance and. Learn what a binder is, why you need it, and what. We analyzed data from more than 30 insurance companies to help you find the best home insurance in virginia. One of the easiest ways to lower your home insurance rate is to have a higher deductible.

A Home Insurance Binder Is A Temporary Contract That Provides Immediate Coverage Until A Formal Insurance Policy Is Issued.

Insurance binders must come from an entity with the legal authority to provide temporary proof of coverage. 20060 coral wind ter, ashburn, va 20147 is pending. Zillow has 28 photos of this $744,950 3 beds, 3 baths, 2,500 square feet condo home located at 43452 founders park ter, ashburn, va 20148 built in 2025. Census bureau, 61.7 percent of.

Insurance Binders Provide Temporary Evidence Of Insurance For Assets Such As Cars, Homes And Commercial Property.

We analyzed data from more than 30 insurance companies to help you find the best home insurance in virginia. A house insurance binder is a document issued by your insurance provider that explains what your home insurance policy covers to your lender. You will pay more out of pocket if you file a claim, but the. A binder is a temporary document that proves your insurance coverage until you get your actual policy.

Below Are The Insurers That Earned 4.5 Stars Or More In Our Analysis.

Title insurance rates are not regulated by the state of virginia, therefore, title rates can vary between title insurers. A homeowners insurance binder is a temporary document that proves your coverage while your policy is being prepared. The state of virginia has three transfer taxes and two recordation taxes. An insurance binder is a temporary, legally binding agreement between the insurer and the insured, providing coverage while the final policy is prepared.

One Of The Easiest Ways To Lower Your Home Insurance Rate Is To Have A Higher Deductible.

Licensed insurance agents or brokers with. In general, homeowners insurance pays for damages and/or losses due to things like theft, fire,. Here's what that could look like in your life: The tiles in order are >> purchase documents, mortgage & tax, insurance, home warranty,.