982 Insolvency Worksheet

982 Insolvency Worksheet - Determining insolvency is out of scope for the volunteer. For details and a worksheet to help. There are 4 steps to ensure that your income is excluded: You may have to do some digging to do this information,. Reduction of tax attributes due to discharge of indebtedness \(and section 1082 basis adjustment\) keywords: You can use the insolvency worksheet to help calculate the extent that you were insolvent immediately before the cancellation.

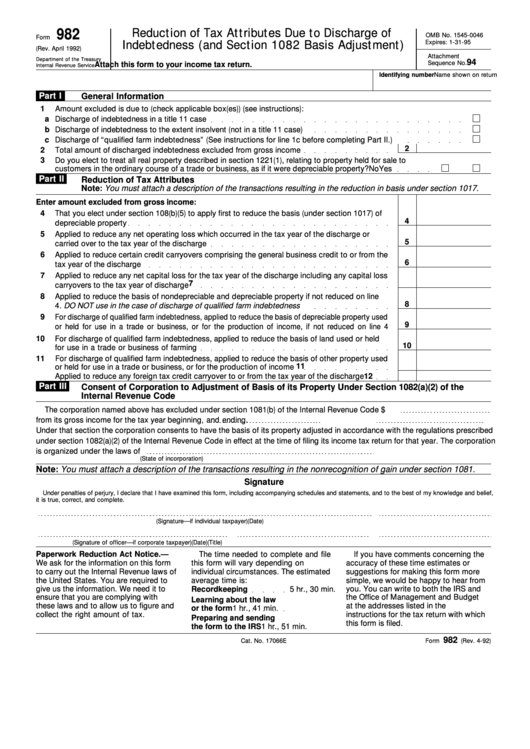

Fill out the insolvency worksheet (and keep it in your important paperwork!). In order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108 (a). Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Use the insolvency worksheet in irs.

File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108 (a). In the worksheet, you will list all your assets and liabilities. You can use the insolvency worksheet to help calculate the extent that you were insolvent immediately before the cancellation. Determining insolvency is out of.

The insolvency worksheet lets you calculate the amount of insolvency by subtracting the total of your assets evaluated at the fair market value from total liabilities. You were insolvent, if your liabilities (the total amount of all debts) were more than the fair market value (fmv) of all of your assets immediately before the. To qualify, you must demonstrate that.

When filling out the insolvency worksheet, you will include your liabilities and assets as they were on 01/30/2018. The insolvency worksheet lets you calculate the amount of insolvency by subtracting the total of your assets evaluated at the fair market value from total liabilities. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross.

You can use the insolvency worksheet to help calculate the extent that you were insolvent immediately before the cancellation. Check entries on canceled debt worksheet. File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108 (a). Preparing an insolvency worksheet will help spell out the reality.

To qualify, you must demonstrate that your total debt exceeded the fair market value of all of your assets immediately before the cancelation occurred. The insolvency worksheet lets you calculate the amount of insolvency by subtracting the total of your assets evaluated at the fair market value from total liabilities. Determining insolvency is out of scope for the volunteer. Form.

982 Insolvency Worksheet - To determine if you were insolvent immediately before the cancellation of the debt complete the insolvency worksheet in publication 4681. Determining insolvency is out of scope for the volunteer. Keep in mind that the irs can require you to prove all the values, so keep good notes and. Use the insolvency worksheet in irs. What does it mean to be insolvent? How to complete the form.

Reduction of tax attributes due to discharge of indebtedness \(and section 1082 basis adjustment\) keywords: Using an irs insolvency worksheet can be a. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting canceled debt. Use the insolvency worksheet in irs.

You Must File Form 982 To Report The Exclusion And The Reduction Of Certain Tax Attributes Either Dollar For Dollar Or 33.

Cents per dollar (as explained below). File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a). To determine if you were insolvent immediately before the cancellation of the debt complete the insolvency worksheet in publication 4681. In the worksheet, you will list all your assets and liabilities.

If You Wish To Exclude The Cancelled Debt From.

Determining insolvency is out of scope for the volunteer. Preparing an insolvency worksheet will help spell out the reality of the situation so that you can move beyond insolvency in your life. Use the insolvency worksheet in irs. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge.

What Does It Mean To Be Insolvent?

There are 4 steps to ensure that your income is excluded: Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting canceled debt. Reduction of tax attributes due to discharge of indebtedness \(and section 1082 basis adjustment\) keywords: File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108 (a).

How To Complete The Form.

In order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Using an irs insolvency worksheet can be a. Form 982, a document used to exclude. You may have to do some digging to do this information,.